I’m not sure it was the best idea to use my student loan money to finish off my contributions in a lump sum. But I have no patience for dollar cost averaging.

By the way, dollar cost averaging is choosing to contribute a specific amount of money into the stock market over a fixed period. Example: You contribute $500 a month for a year. At the end of the year, you have contributed $6000 as opposed to lump sum investing, which is just contributing $6000 on January 1st.

Dollar-cost averaging is arguably a better strategy to account for ups and downs in the market. For example, what if you put all $6000 on January 1st when the market was at its highest. As opposed to spreading the risk throughout the year.

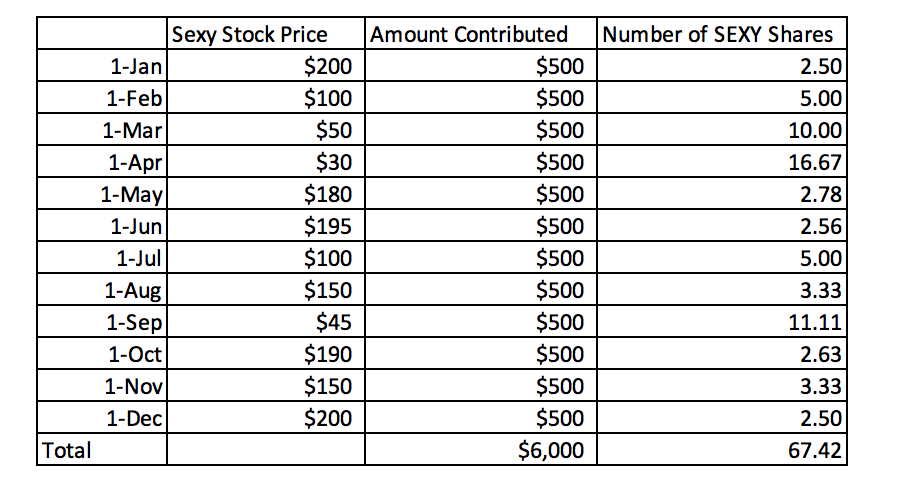

Think about it this way, if Jan 1st, the price of SEXY stock was $200 – you get 30 shares of SEXY if you contributed $6000 that day ($6000/$200). But throughout the year, SEXY fluctuated. Look at table below:

So if you contributed the same $6000 spread through the year instead, you’d get 67.42 shares instead of 30 shares. However, SEXY is kinda trash if the price fluctuates so drastically during the year.

Hmm, so why did I give up 8 months into doing dollar cost averages? Because I’m a checklist-typa-bitch. In the end, it is a long-term investment. So whether it was spread out or lump sum, in 10 years, the market will have corrected itself. I am investing in total market index funds – mostly VTSAX, which historically has a 7-10% return for long-term investors.

What am I gonna do about my student loans, though? Well, that’s a story for another day.

XOXO Gen Z Fire Baby

Leave a comment